Breaking

BREAKING: FG tenders apology for asking bank account holders to fill self-confirmation form

The Federal Government has apologised for asking all account holders in the country’s financial institutions to register their details again via the self-confirmation form.

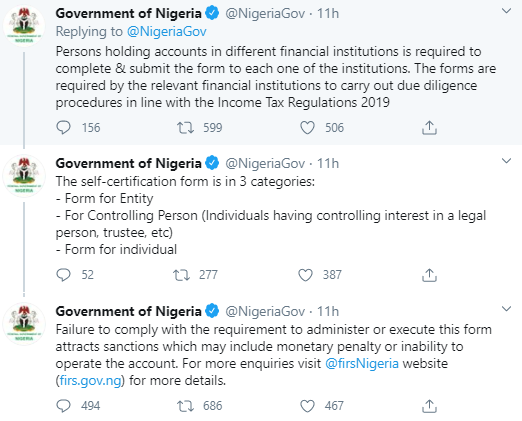

Recall that the FG announced on Thursday that all account holders in banks, including insurance companies, to fill and submit a Self-Confirmation form.

The order was met with a lot of criticism from Nigerian who feel it undermines the credibility of the Bank Verification Number and the National Identification Number by account holders.

in the previous announcement, the FG had attached a monetary penalty of blocked access to defaulters’ accounts for failure to fill the form.

However, in a tweet on Friday, the government apologised for misinformation.

It tweeted, “We apologise for the misleading tweets (now deleted) that went up yesterday, regarding the completion of self-certification forms by Reportable Persons. The message contained in the @firsNigeria Notice does not apply to everybody. FIRS will issue appropriate clarification shortly.”

We apologize for the misleading tweets (now deleted) that went up yesterday, regarding the completion of self-certification forms by Reportable Persons. The message contained in the @firsNigeria Notice does not apply to everybody. FIRS will issue appropriate clarification shortly pic.twitter.com/KBiPh0lCwJ

— Government of Nigeria (@NigeriaGov) September 18, 2020

In a press statement, the Federal Inland Revenue Service explained that only “reportable persons” are expected to submit the form.

The statement read, “This is to clarify the publication for financial institutions account holders in Nigeria to complete the self-certification form, pursuant to the Income Tax (Common Reporting Standard) Regulations 2019 which is for the fulfilment of Automatic Exchange of Information Requirements.

The Self Certification form is basically to be administered on Reportable persons holding accounts in Financial institutions that are regarded as “Reportable Financial Institutions” under the CRS.

“Reportable persons are often non-residents. And other persons who have a residence for tax purposes in more than one jurisdiction or Country.

“Financial Institutions are expected to administer the Self Certification form on such account holders when the information at its disposal indicates that the Account holder is a person resident for tax purpose in more than one jurisdiction.

“The information that indicates an account holder is a resident for tax purposes in more than one jurisdiction, is expected to be available to Financial Institutions during the account opening processes for the KYC and AML purpose.”

-

Politics23 hours ago

Politics23 hours agoZamfara bans officials from radio, TV interviews

-

News22 hours ago

News22 hours agoKastina police foil attack, neutralize suspected bandit

-

News19 hours ago

News19 hours agoKenneth Okonkwo knocks CBN’s forex management amid economic struggles

-

News19 hours ago

News19 hours agoNavy nabs 14 criminals in Akwa Ibom

-

News15 hours ago

News15 hours agoGoldman Sachs donates $5000 to Tunde Onakoya’s world record fundraiser

-

News19 hours ago

News19 hours agoUTME: JAMB calls for calm amid technical glitches

-

Education15 hours ago

Education15 hours agoPlateau varsity mourns student’s death, suspends exams

-

Entertainment15 hours ago

Entertainment15 hours agoBurna Boy, Nollywood receive praise from Canadian senate